Secured Loans Made Simple

Up to 50% Lower Costs on Secured Loans

Why Pay More?

“Excellent company, half the price of competitors” Timothy Healy @ Reviews.co.uk

Great Rates. Zero Risk

Secured Loans for any Purpose

Looking to pay off high-interest debts and reduce your monthly payments, renovate home, or finance a big purchase?

A secured loan from loan.co.uk could be a great solution. Unlock the potential of your home’s equity and borrow from £15,000 up to £1.5 million, with no upfront costs. Also, a secured loan won’t affect your current mortgage rate.

Why Choose loan.co.uk? Costs are up to 50% lower than most brokers, so you can feel confident that you’re getting the best value for your money.

Our award winning, friendly team is here to help you find the perfect secured loan for your situation and budget. We’ll work with you every step of the way to make sure you get the best deal possible. With loan.co.uk, you can trust that you’re making a smart choice.

Low-Cost Secured Loans Online

✓ Borrow from £15,000 to 1.5 million

✓ Free property valuation

✓ No upfront fees or hidden charges

✓ High loan-to-value options

✓ Plans for poor credit scores available

✓ Multiple award-winning services from Loan.co.uk™

Up to 50% lower costs than all other major brokers

Voted: Secured Loan Broker of the Year

Lower Monthly Payments with Debt Consolidation

Pay less, stress less, live more. Lower monthly payments, consolidate your debt today.

Fall in Love with Your Home Again

Renovate, expand. Upgrade your lifestyle and boost your property value.

Flexible Funding for Life’s Goals

Weddings, emergencies, investments – we’ve got you covered.

Zero Upfront Fees, Total Transparency

Get the secured loan you need without surprise costs.

Your Credit Score is OK with Us

We find solutions, not roadblocks

Up to 50% lower costs than all other major brokers

Voted: Secured Loan Broker of the Year

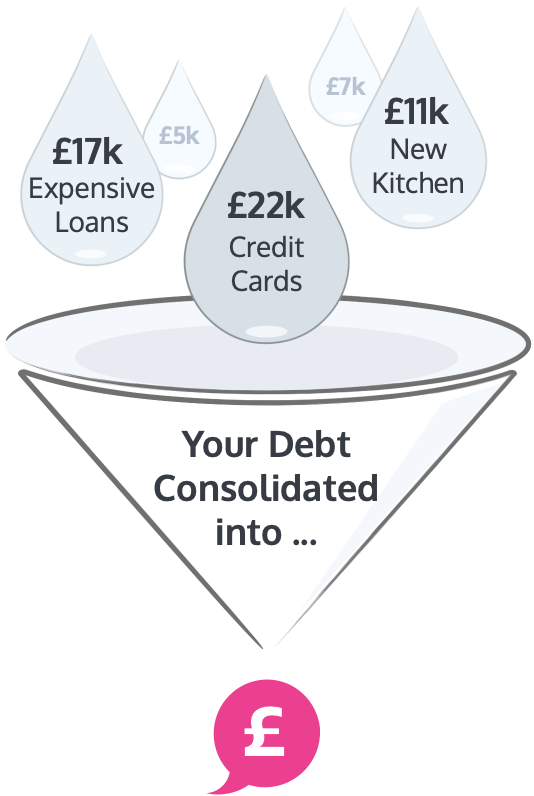

Debt Consolidation made Simple

“Loan.co.uk managed to reduce my payments from £1,500 a month to less than £300 – Lifechanging.” Ben @ Trustpilot

Struggling with High Monthly Payments?

Paying too much for credit cards and loans? Home improvements, taking a backseat? Want to simplify your debts, and save money each month? Our debt consolidation plan makes it possible.

Save up to 75% on your Current Monthly Payments

Tired of juggling multiple debts and high monthly payments? A secured loan from loan.co.uk can help you save up to 75% on your monthly repayments, giving you the breathing room you need to take control of your finances.

Regain Control and Consolidate Your Debts

By consolidating your debts into a single, manageable payment, you can simplify your life and get back on track. Plus, you might even have some extra funds left over for those home improvements you’ve been putting off.

Don’t let debt control your life any longer. Take the first step towards financial freedom with our secured loan debt consolidation solution today!

“Loan.co.uk rescued us from a mountain of debt. The best thing we have ever done. We now save so much every month, we can have a life again.” Julie @ Trustpilot

Up to 50% lower costs than all other major brokers

Voted: Secured Loan Broker of the Year

BEST VALUE

Catch Z’s,

Not Fees

- Rest easy with up to 50% lower costs

- No upfront fees

- Free property valuation & legal costs

“their fees are the cheapest in the market, and they really do care about getting you the right product”

BETTER SERVICE

Say hello to

5-star service

- No sales pressure, just support

- Personal friendly UK expert

- Transparent journey in our app

“they explained everything super clearly and a first class service from start to finish”

“One of the best services I’ve used in my life” Kimberley Ramsey @ Trustpilot

As featured in

What is a Secured Loan?

A secured loan, also known as a homeowner loan, is a special type of loan that lets you borrow money by putting up a valuable asset, like a car, an item of value, or, most commonly, the equity in your home, as collateral. At Loan.co.uk, we only arrange borrowing money on loans secured on the property.

Why are secured loans so attractive? Because they’re less risky for lenders, they often let you borrow a larger sum than a personal loan or unsecured loan. Plus, they usually come with lower interest rates, which is always a bonus!

Like any loan, you’ll make monthly repayments, including interest calculated on your outstanding balance. But remember, secured loans come with a catch. If you can’t keep up with your repayments, the lender may have the right to take possession of the asset you used as collateral, which could even be your home.

How Does a Secured Loan Work?

Secured loans work much the same as any other loan. You repay the money you borrowed, plus interest, in regular monthly payments over a specific timeframe, known as the “repayment period.”

Choosing a longer repayment term will give you lower monthly repayments, but you’ll end up paying more interest over time. On the other hand, a shorter repayment term will mean higher monthly payments but less interest overall.

The interest rate on a secured loan can be either fixed or variable. With a fixed rate, you’ll pay the same amount each month, while with a variable rate, your monthly repayment could increase or decrease.

We offer both fixed and variable rates on secured loans. Plus, we have flexible repayment periods ranging from 3 to 25 years, customised to your borrowing needs. Let us help you find the best option!

Save up to 50% on costs compared to all other major brokers

Voted: Secured Loan Broker of the Year

3 Easy Steps to Your Perfect Secured Loan

Finding the right loan can feel overwhelming! Let Albot, our friendly AI helper, be your guide. Albot will compare loans from top lenders in seconds, finding the best rates for your needs. It’s simple, stress-free, totally secure and won’t to affect your credit score.

Apply now and let ALBOT work its magic!

1. Fast Online Application: Our chat application takes the pain out of loan searching. No paperwork, no credit score worries.

2. AI-Powered Matchmaking: Albot, instantly compares thousands of loans to find your perfect match, at the best possible rate.

3. Relax! Let us do the heavy lifting. Just sit back until your loan arrives.

Don’t just take our word for it

4.97/5 Rating

Rich Smith

“Excellent service in arranging a secured loan for me. They made the process very easy and sourced a lender at a good fixed rate, with no exit penalties. I would highly recommend Loan.co.uk. Thanks guys!”

VERIFIED REVIEW

Matthew Frary

“Applied for a secured loan, and everything was prompt and efficient, called when they said and instantly felt at ease with the company. The advisor that called me was one of the nicest people I’ve ever spoken to on the phone and could not have been more helpful. I won’t hesitate to use Loan.co.uk in the future.”

VERIFIED REVIEW

Angela

“I am very pleased with Loan.co.uk’s service. They have secured a loan for us in under 2 weeks. They made everything extremely easy and stress-free, keeping me updated on an extremely regular basis. I would highly recommend.”

VERIFIED REVIEW

A broker that’s on your side

Getting a quote has no effect on your credit score

Always get the best secured loan available to you

What are the benefits of secured loans?

Secured loans often offer lower interest rates, higher loan amounts, and longer repayment terms compared to unsecured loans. They can be a good option for borrowers who need a larger loan or have a less-than-perfect credit history.

Can I apply for a secured loan with a bad credit score?

Yes, you can apply for a secured loan with bad credit. Since the loan is secured with collateral, lenders may be more willing to approve your application despite a poor credit report or history.

How much can I borrow with a secured loan?

The amount you can borrow with a secured loan depends on the value of your collateral, your credit history, and your ability to repay the loan. At Loan.co.uk you can borrow from £10,000 to over a million depending on status.

What is the typical repayment period for secured loans?

Repayment periods for secured loans can range from 3 to 25 years, depending on the loan amount, your financial situation, and the lender’s terms.

Are there any fees associated with secured loans?

Yes, there may be fees associated with secured loans, such as lender arrangement fees, broker fees, and early repayment charges. Make sure to review the loan agreement carefully to understand all associated costs.

Can I make overpayments or pay off my secured loan early?

Many lenders allow overpayments and early repayment of secured loans, but some may charge early repayment fees. Check the terms and conditions of your loan agreement for details.

Can I get a secured loan if I'm self-employed?

Yes, self-employed individuals can apply for secured loans. However, you may need to provide additional documentation, such as tax returns and business financial statements, to prove your income and financial stability.

Can I use a secured loan to consolidate debt?

Yes, secured loans can be used to consolidate debt. By consolidating multiple debts into a single secured loan, you may be able to reduce your monthly payments and simplify your finances. If you extend your entire loan term, you may pay more interest in the long run.

How long does it take to get approved for a secured loan?

The approval process for a secured loan can vary depending on the lender and your financial situation. In some cases, approval can be granted the same day you apply, while others may take several weeks.

What’s the difference between a secured and unsecured loan?

An unsecured loan, often referred to as a personal loan, is not linked to your home or any other asset. Since there’s no collateral for lenders to claim if you’re unable to repay, unsecured personal loans are generally viewed as a higher risk for lenders. As a result, you’ll usually need a good credit score to get approved, which reassures lenders that you’re more likely to repay the loan.

Similar to a secured loan, when you take out a secured or unsecured loan, you’ll agree to specific repayment terms, including an interest rate and a repayment period. Credit cards are another form of unsecured credit – they’re also known as revolving credit because you borrow and repay money on a monthly basis.

How does Loan.co.uk help me find the best secured loan?

Loan.co.uk compares secured loan offers from a wide range of lenders to help you find the best loan that suits your needs. Our comparison tool makes it easy to compare interest rates, loan amounts, and repayment terms from multiple lenders. We also offer secured loans that have up to 60% fewer costs than most other major brokers.

Secured loans use your property as security. If you fall behind on payments, your home is at risk.

Consolidating debt may increase the repayment term and total amount repaid.

We are a broker, paid commission to arrange secured loans. Broker fees are subject to status, loan amount and lender plan. Rates depend on your circumstances. Loans are subject to approval.

Representative Example for secured loans & Second Charge Mortgages: If you borrow £18,000 over 10 years, initially on a fixed rate for 5 years at 7.4% and for the remaining 5 years on the Lender's standard variable rate of 7.9%, you would make 60 monthly payments of £249.27 and 60 monthly payments of £254.63. The total amount of credit is £19,657 (this includes a Lender Fee of £595 and a Broker Fee of £1,062). The total repayable would be £30,234.00. The overall cost for comparison is 10.42% APRC representative. This means 51% or more of our clients receives this rate or better for this type of product. We have arranged borrowing with rates from 4.9% to 29% APRC which has allowed us to help customers with a range of credit profiles. We are a broker not a lender.

Secured Loans have a minimum term of 36 months to a maximum term of 360 months. Maximum APRC charged 29%. If you are thinking of consolidating existing borrowing you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.